Putting together a robust set of employee medical benefits can be a complicated process, even for the most experienced HR professional. Employee medical benefits are a crucial part of cultivating a good workplace environment; and can influence morale amongst your employees, especially if health is top of mind for them.

We’re here to share the essential things you need to know about workplace healthcare and medical benefits so that you can make the best decisions for your workforce.

Good employee medical benefits provide your company with rich returns.

Robust employee health benefits are important for the growth of your company. For one, better health means fewer sick days taken. It’s estimated that Singaporeans take a total of 315,000 days of sick leave every year due to influenza and the flu! That’s a lot of time spent with a sniffly nose out of the office — and could also impact your bottom line.

Additionally, strong employee medical benefits can contribute to your employer branding; and that’s important if you want to attract top talent! A good corporate health programme is key to branding and staff retention. According to the consultancy firm Willis Towers Watsons, 78% of employees said their benefits programme is a reason for why they’d stay with their current employer.

Employee medical benefits plan have several components

There are two essential parts of an employee medical benefits plan: 1) inpatient coverage, 2) outpatient coverage. In addition to this, some companies also provide preventative care.

Inpatient Coverage

Inpatient coverage refers to medical treatment and services when the patient has to be admitted overnight at the hospital.

Examples of inpatient care include:

- Going for routine and complicated surgeries that require an overnight stay at the hospital

- Seeking treatment for serious medical conditions that require closer monitoring (e.g. e.g chemotherapy, renal dialysis, rehabilitation)

- Childbirth and pregnancy complications

Outpatient Coverage

Outpatient coverage refers to medical treatment and services that don’t require an overnight stay at the hospital. As the patient doesn’t need to be admitted for observation, outpatient care tends to be for less serious or complicated medical conditions and procedures.

Examples of outpatient care include:

- Seeing the GP if you’re feeling unwell and have fallen ill (including seeing a doctor over video-consultation)

- Consulting a specialist for their medical advice

- Going for rehabilitation (e.g. physiotherapy)

- Going for minor surgeries (e.g. cataract surgery)

- Having diagnostic tests and procedures (e.g. scans, blood tests)

As you can guess, your employees are more likely to require outpatient care coverage, so it is an important component of your benefits plan. There are administrative services that help you manage, administer and track utilisation of these employee medical benefits.

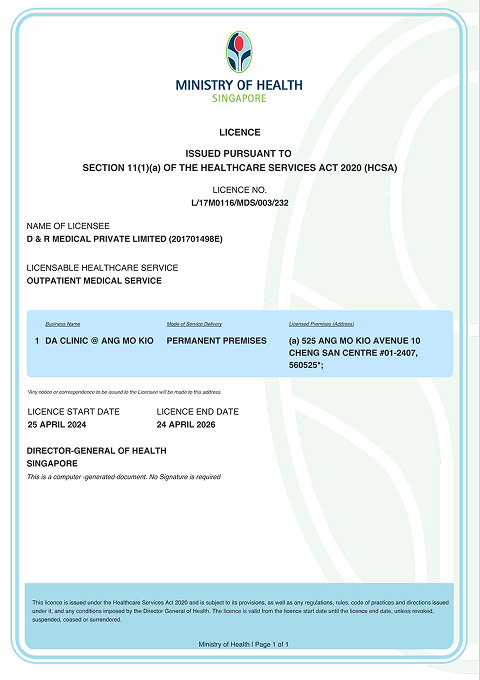

DA Care is one such option, if you’re looking for an outpatient medical benefits solution. DA Care helps your HR team with customised outpatient healthcare coverage and dedicated third party administration support for delivering your chosen employee medical benefits.

Preventative Care

While not mandatory, good-to-have component of your employee medical benefits is preventative healthcare services. As its name suggests, the purpose of preventative services is to prevent serious illness: whether it’s through early detection from a health screening or minimising the risk of falling sick with a vaccination.

Including preventative care in your employee medical benefits coverage can definitely be a plus in terms of employer branding, and is quite common across larger companies.

Common considerations for your employee medical benefits plan

When designing your company’s medical benefits plan, these are a few factors you may need to consider:

- Size of your budget: Your budget will limit the extent of coverage that you’re able to offer your employees.

- Workplace health needs of your company: This is dependent on the demographic profile of your employees as well. For example: an older staff may require coverage for more chronic health conditions.

- Territory coverage: You can choose to include coverage for medical expenses incurred overseas (e.g. when your staff falls ill on a holiday and sees a doctor in the country they’re in), or opt to limit coverage for just local treatment.

Ready to get started? Get in touch with us on how we can support your company’s outpatient employee medical benefits. We’re experienced in bringing quality healthcare to the workplace: whether it’s administrative work in disseminating benefits or organising engaging workplace events.